FIRST BUSINESS FINANCIAL SERVICES (FBIZ)·Q4 2025 Earnings Summary

First Business Bank Beats EPS by 14% Despite Revenue Miss; Dividend Hiked 17%

January 30, 2026 · by Fintool AI Agent

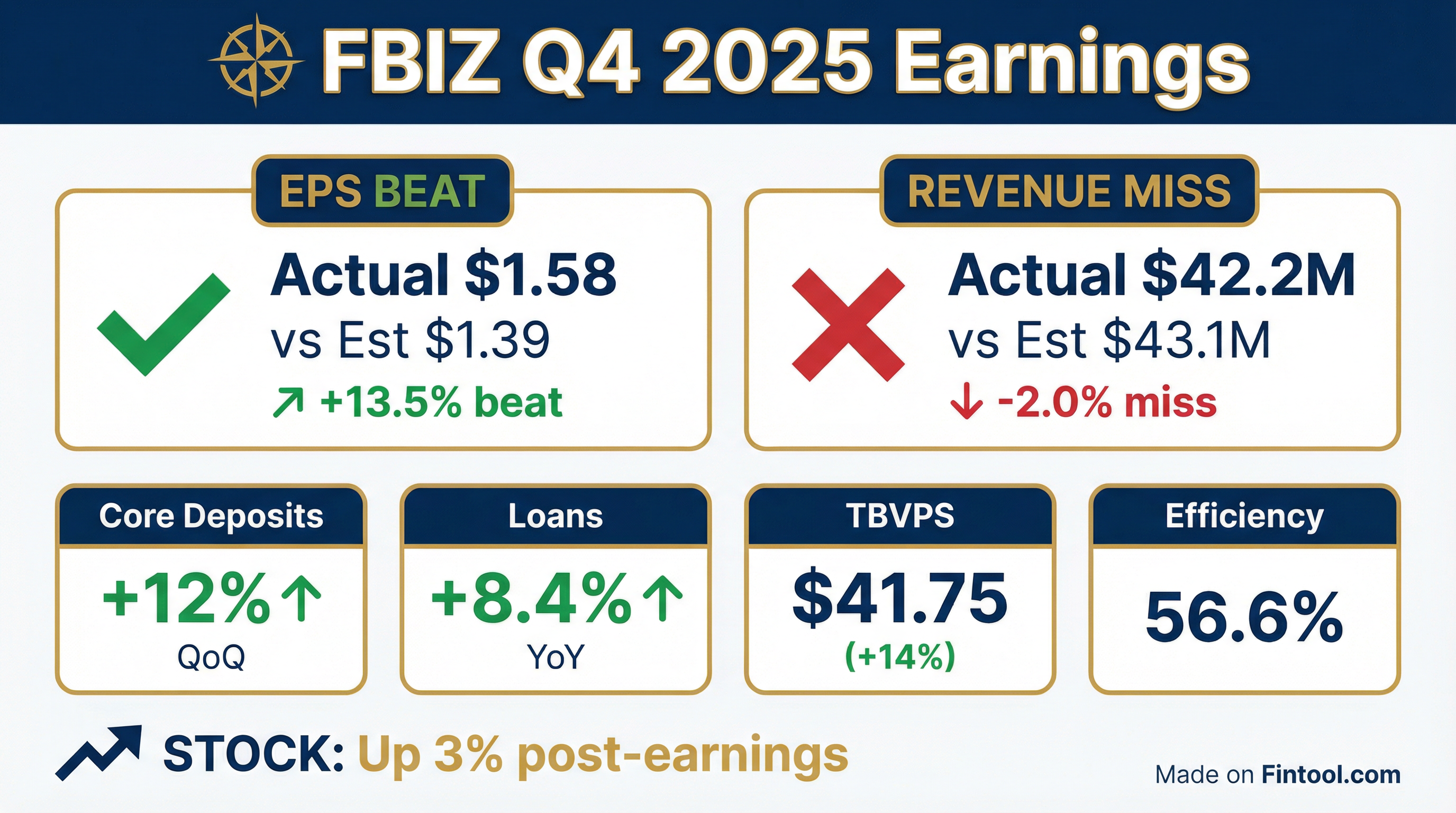

First Business Financial Services (NASDAQ: FBIZ) reported mixed Q4 2025 results, beating EPS estimates by a healthy 13.5% while missing revenue expectations. The Wisconsin-based commercial bank delivered $1.58 in diluted EPS versus consensus of $1.39, capping a year of 14% EPS growth. However, operating revenue of $42.2M fell 2.0% short of the $43.1M Street estimate.

The earnings beat was overshadowed by a notable increase in non-performing assets from a single borrower relationship, though management emphasized strong collateral positions and isolated nature of the credit event.

Did First Business Bank Beat Earnings?

EPS: Beat by 13.5% — Reported $1.58 vs. $1.39 consensus. This extends FBIZ's streak of EPS beats to 7 consecutive quarters.

Revenue: Missed by 2.0% — Operating revenue of $42.2M came in below the $43.1M estimate, reflecting lower non-interest income versus Q3's elevated levels.

Full Year 2025 Performance

CEO Corey Chambas highlighted the bank's track record: "Over the past 10 years, we've grown earnings per share at 12% compound annual rate. Going back to the year of our IPO in 2005, our 20-year compound average annual EPS growth is 10%, a very long period of outstanding performance."

How Did the Stock React?

FBIZ shares rose +2.98% following the earnings release, trading at $57.09 versus the prior close of $55.44. The stock is up approximately 35% over the past 12 months.

What Changed From Last Quarter?

Net Interest Margin Compression

NIM declined to 3.53% from 3.68% in Q3 2025, though this included a 10 basis point negative impact from non-accrual interest reversals ($892K). Excluding this item, NIM was 3.63%.

Non-Performing Asset Spike

NPAs jumped to 1.07% of total assets from 0.58% in Q3 2025, driven by a single borrower downgrade:

- $20.4M of CRE loans related to a Wisconsin-based borrower were downgraded (total relationship: $29.7M)

- 72% LTV across seven cross-collateralized properties

- Cause: Long-standing client acquired land parcels for multifamily development but was unable to advance to development phase due to internal management challenges, exhausting free cash flow

- Collateral: Majority is land zoned for multifamily in southeastern Wisconsin (Milwaukee-Chicago corridor); appraisals exceed carrying values; no specific reserve recorded

- Non-accrual interest reversal: $892K reversed, compressing NIM by 10 basis points

Management characterized this as an "isolated event" with strong collateral positions and expects resolution progress quarter by quarter throughout 2026.

Efficiency Improvement Continues

The efficiency ratio improved to 56.61% from 57.44% in Q3 2025, marking the fourth consecutive year of positive operating leverage. Full-year efficiency ratio was 58.78% versus 60.61% in 2024.

What Did Management Guide?

FBIZ does not provide explicit quarterly guidance but reiterated strategic plan targets through 2028. CFO Spielmann confirmed NIM target range of 3.60%-3.65% remains unchanged, with expectations for 10% annual loan, deposit, and revenue growth.

Forward Consensus Estimates

Values retrieved from S&P Global

Key Highlights

Dividend Increase — 14th Consecutive Year

The board declared a 17% dividend increase to $0.34 per share quarterly, payable February 28, 2026. This marks the 14th consecutive annual dividend raise.

- Dividend Yield: ~2.45%

- Payout Ratio: 22% of Q4 earnings

Balance Sheet Growth

Capital Position

CEO Succession

Corey Chambas will retire as CEO on May 2, 2026. President and COO David R. Seiler will succeed him as President and CEO.

Loan Portfolio Composition

The C&I portfolio continues to outpace CRE growth with a 3-year CAGR of 18% versus 10% for CRE.

Credit Quality

Despite the single-borrower NPA increase, the performing portfolio remains strong:

- 99.4% of loans are current

- 92% of loans classified in Category 1 (best risk rating)

- Allowance for credit losses: 1.12% of total loans

- Net charge-offs remain minimal

Management noted: "Outside the isolated NPL, the remainder of the portfolio continues to perform as expected, with no areas of concern."

Equipment Finance Transportation Portfolio: Down to $20M from $61M at peak, continuing to shrink as expected. Q4 charge-offs ($2.5M) were primarily from this previously-reserved portfolio.

Other ABL Credit: A legacy ABL non-performing credit from 2023 remains in the court system with a court date set for later in 2026.

Liquidity Position

66% of deposits are FDIC insured or collateralized, down slightly from 69% in Q4 2024.

EPS Beat/Miss History

Values retrieved from S&P Global

FBIZ has beaten EPS estimates in 7 of the last 8 quarters.

Q&A Highlights

Problem Loan Resolution Timeline

Daniel Tamayo (Raymond James) asked about collateral values and expected timeline. Management confirmed the seven properties are cross-collateralized with an overall 72% LTV. Fresh appraisals were obtained at year-end for the larger land parcels.

CEO Chambas on resolution: "Because there are multiple pieces of real estate here, there can be shorter-term progress, potentially with some pieces of this, even in the very near term... I wouldn't be surprised if there were something happening every quarter over the course of the year in terms of making progress."

Margin Outlook

Nathan Race (Piper Sandler) asked about the NIM starting point for Q1. CFO Spielmann clarified: "When you adjust for the non-accrual interest in Q4, that resets us at 3.63%. With the mix we're seeing in the pipelines... we feel like we have the ability to maintain that within our range of 3.60-3.65%."

Loan Growth Confidence

Damon DelMonte (KBW) questioned the return to double-digit loan growth. Management noted payoffs were ~$70M higher than normal in 2025; normalized growth would have been 10-11%.

COO Seiler: "It really isn't a new business volume issue for us. It was really higher than normalized payoff levels, particularly in the second half of the year."

CEO Chambas added: "It's about our people and our teams... Right now, we feel really good. We have the best team we've ever had."

Specialty Lending Targets

Brian Martin (Janney) asked about specialty lending expansion. Specialty niches represent 23% of the portfolio currently, down from a peak of 25%+. Target is to return to 25% in the near term, with 30% as the aspirational goal. ABL pipeline is "particularly good."

M&A Philosophy

Nathan Race (Piper Sandler) asked about acquisition opportunities. Chambas was direct: "We're so unique with our model that there's just not many things that look like us. We don't value branch networks... We believe the best way to drive value for existing shareholders is through organic growth. You're not diluting them by issuing shares."

Fee Income Guidance

Management confirmed the fee income growth base is approximately $33M (adjusted 2025), with 10% full-year growth expected. SBA gain on sale averaged ~$500K/quarter in 2025 and is expected to rebound as the government shutdown impact fades.

Key Takeaways

- EPS strength continues — 14% annual EPS growth extends FBIZ's two-decade track record of double-digit compound growth

- NPA spike is isolated — Single borrower CRE downgrade with 72% LTV; seven properties cross-collateralized with strong collateral; no reserve required

- Dividend momentum — 17% increase marks 14th consecutive annual raise

- Efficiency gains — Sub-60% efficiency ratio for 2025 with positive operating leverage for fourth straight year

- NIM reset — Adjusted NIM of 3.63% excluding non-accrual reversal; target range of 3.60-3.65% unchanged

- Specialty lending upside — At 23% of portfolio vs. 25-30% target; ABL pipeline particularly strong